Chers professionnels, vous le savez mieux que personne : investir dans des équipements de qualité est essentiel pour rester compétitif. Mais avez-vous pensé au leasing ? Cette solution de financement méconnue offre de nombreux avantages pour les entreprises, artisans et commerçants. Découvrons ensemble pourquoi le leasing pourrait bien devenir votre meilleur allié !

Le leasing, qu’est-ce que c’est exactement ?

Le leasing, aussi appelé crédit-bail ou location avec option d’achat (LOA), est un contrat de location d’un bien, assorti d’une option d’achat à terme. Concrètement, vous louez un équipement pour une durée déterminée, en contrepartie de loyers mensuels. À la fin du contrat, vous pouvez décider d’acheter le bien, de le restituer, ou de renouveler la location.

Le leasing concerne une large gamme d’équipements professionnels :

- Véhicules utilitaires et de fonction

- Matériel informatique et bureautique

- Machines industrielles et outillage

- Équipements médicaux

- Systèmes de sécurité et de vidéosurveillance

Il existe différents types de contrats de leasing, adaptés à vos besoins et à votre situation :

La location financière

Aussi appelée crédit-bail, c’est la forme la plus courante de leasing professionnel. Elle s’adresse aux entreprises souhaitant financer des biens d’équipement sur une longue durée (de 3 à 7 ans en général). À la fin du contrat, vous pouvez lever l’option d’achat pour un montant fixé à l’avance, généralement entre 1 et 5% de la valeur initiale du bien.

Le leasing opérationnel

Cette formule est particulièrement adaptée pour les biens à obsolescence rapide, comme le matériel informatique ou les véhicules. La durée du contrat est plus courte (de 1 à 5 ans), et les loyers intègrent souvent des services complémentaires comme l’entretien ou l’assurance. À l’issue du contrat, vous pouvez restituer le bien ou le renouveler, mais il n’y a pas d’option d’achat.

La location avec option d’achat (LOA)

Très prisée pour les véhicules professionnels, la LOA ressemble à un crédit classique, mais avec une grande souplesse à la fin du contrat. Vous pouvez choisir d’acquérir le véhicule pour sa valeur résiduelle (fixée à la signature), de le restituer, ou de renouveler le contrat pour repartir sur un véhicule neuf. Idéal pour les entreprises qui veulent maîtriser leur budget auto sur le long terme.

Pourquoi le leasing séduit de plus en plus d’entreprises ?

Si le leasing a le vent en poupe, c’est qu’il offre de nombreux avantages par rapport à l’achat. Jugez plutôt :

Préserver votre trésorerie

En optant pour la location, vous évitez d’immobiliser une grosse somme d’argent dans l’achat d’équipements coûteux. Vos loyers sont lissés sur la durée, ce qui vous permet de gérer plus sereinement votre budget. Idéal pour les entreprises qui démarrent ou qui traversent une passe délicate !

Accéder aux dernières technologies

Avec le leasing, fini les équipements obsolètes qui plombent votre productivité. Vous pouvez renouveler régulièrement votre matériel pour rester à la pointe de l’innovation. Un atout de taille dans des secteurs où la technologie évolue à vitesse grand V, comme l’informatique ou la sécurité.

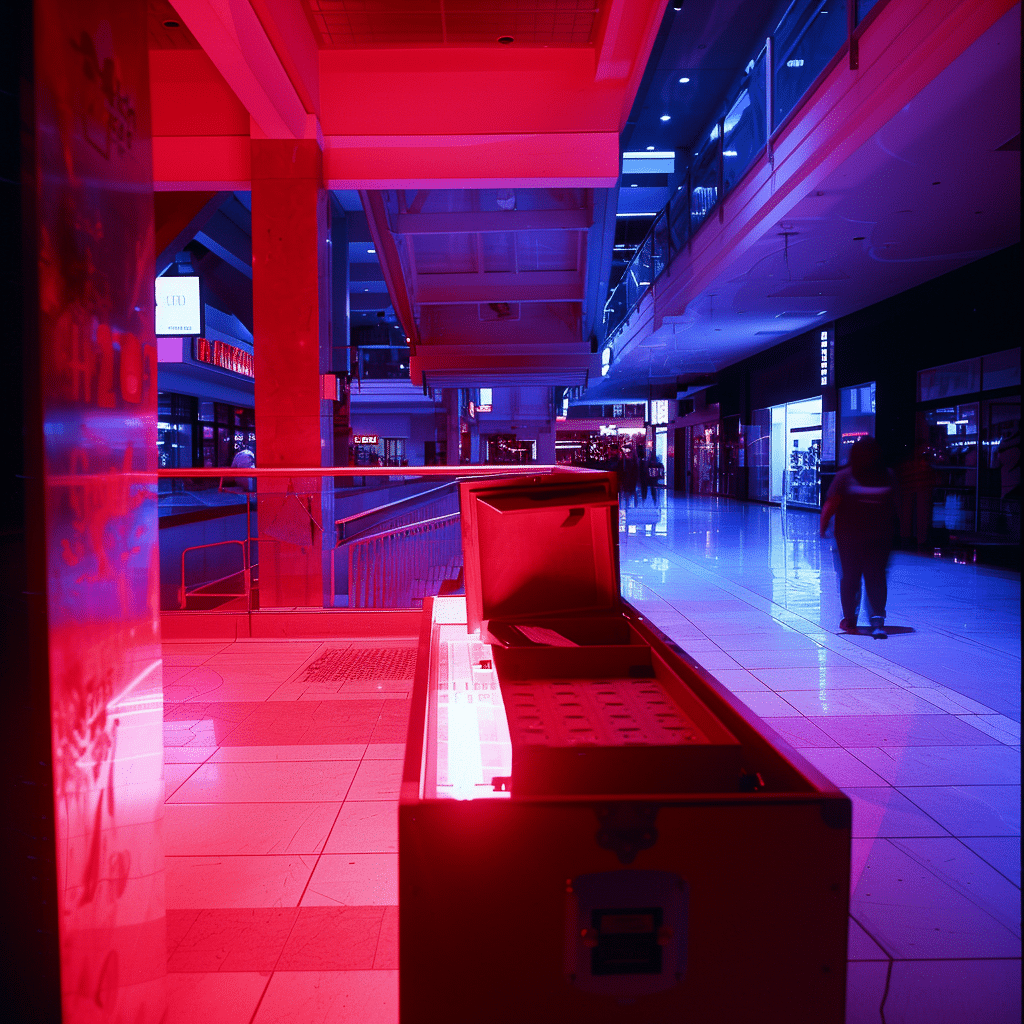

Le cas des caméras de vidéosurveillance

Les caméras IP dernière génération offrent des fonctionnalités avancées comme la reconnaissance comportementale, la détection de mouvements, ou encore le comptage de personnes. En les louant, vous pouvez bénéficier de ces technologies de pointe sans vous ruiner, tout en restant à jour des dernières normes de sécurité.

Simplifier la gestion de vos équipements

Avec un contrat de leasing, c’est le loueur qui se charge de l’entretien et des réparations de votre matériel. Plus besoin de courir chez le dépanneur ou de gérer des pannes inopinées. Vous pouvez vous concentrer sur votre cœur de métier en toute sérénité.

Les avantages fiscaux du leasing pour les professionnels

En plus de ses atouts pratiques, le leasing offre des avantages fiscaux non négligeables pour les entreprises :

La déductibilité des loyers

Les loyers versés dans le cadre d’un contrat de leasing sont considérés comme des charges d’exploitation, déductibles du résultat imposable. Concrètement, cela vous permet de réduire votre bénéfice et donc votre impôt sur les sociétés.

La déductibilité fiscale des loyers est plafonnée à 18 300 € par véhicule et par an, ou à 9 900 € si le véhicule a des émissions de CO2 supérieures à 200g/km.

Un impact positif sur le bilan comptable

En optant pour le leasing plutôt que l’achat, vous préservez vos fonds propres et votre capacité d’endettement. En effet, les biens financés en crédit-bail n’apparaissent pas à l’actif de votre bilan, contrairement à ceux acquis en crédit classique. Votre entreprise présente ainsi une structure financière plus saine, ce qui peut faciliter l’obtention de prêts ou convaincre de potentiels investisseurs.

Attention toutefois à ne pas vous surendetter : même si les loyers ne figurent pas en tant que dettes au bilan, ils représentent bien un engagement financier à long terme. Il convient donc de bien mesurer vos capacités de remboursement avant de vous lancer.

Une souplesse comptable bienvenue

Avec un contrat de leasing, vous pouvez adapter le montant et la durée de vos loyers à votre situation financière et à vos besoins. Vous pouvez ainsi opter pour des loyers progressifs si votre activité est en croissance, ou au contraire des loyers dégressifs si vous anticipez une baisse de vos revenus. De même, vous pouvez aligner la durée du contrat sur la durée d’amortissement comptable ou fiscal du bien, pour optimiser votre bilan.

Enfin, le leasing vous permet de lisser le coût d’acquisition d’un bien sur plusieurs exercices comptables, plutôt que de supporter une grosse dépense ponctuelle. Un atout appréciable pour gérer votre trésorerie et stabiliser vos résultats.

L’étalement de la TVA

Autre avantage fiscal du leasing : vous pouvez récupérer la TVA sur vos loyers de façon étalée, tout au long du contrat. Un atout pour votre trésorerie, surtout si vous êtes assujetti à la TVA sur les débits.

L’exonération de TVS pour certains véhicules

Bonne nouvelle si vous louez des véhicules professionnels : certains sont exonérés de taxe sur les véhicules de société (TVS). C’est le cas des utilitaires, des véhicules de plus de 9 places, mais aussi de ceux qui fonctionnent au super-éthanol E85, au GPL ou à l’électricité.

Pour les véhicules non-polluants, l’exonération de TVS ne s’applique que pour une durée de 2 ans.

Quels équipements louer plutôt qu’acheter ?

Si le leasing peut concerner une large gamme d’équipements, certains s’y prêtent particulièrement bien. Petit tour d’horizon des incontournables :

Informatique et bureautique

Ordinateurs, imprimantes, serveurs… Le matériel informatique est le grand gagnant du leasing. En le louant, vous pouvez renouveler votre parc régulièrement sans vous ruiner, et bénéficier d’un service de maintenance inclus. De quoi éviter bien des tracas au quotidien !

Véhicules utilitaires et de société

Le leasing auto est très prisé des entreprises, et pour cause : en plus des avantages fiscaux, il permet de rouler dans des véhicules récents et bien équipés, sans se soucier de la revente. Idéal pour les commerciaux ou les artisans qui ont besoin d’un utilitaire fiable.

Équipements de sécurité

Caméras, portiques antivol, systèmes d’alarme… Les équipements de sécurité évoluent sans cesse. En les louant, vous pouvez bénéficier des dernières technologies de pointe, tout en étalant la dépense dans le temps. Un must pour sécuriser vos locaux sans vous ruiner.

Matériel industriel et de chantier

Pelleteuses, chargeuses, grues, compresseurs… Les engins de chantier représentent un investissement colossal pour les entreprises du BTP. En les louant, vous pouvez disposer de matériel récent et performant sans immobiliser votre trésorerie. Les contrats incluent généralement l’entretien et la maintenance, pour éviter les coûts liés aux pannes et à l’usure.

Équipements médicaux

IRM, scanner, mammographe… Les équipements médicaux coûtent une fortune et évoluent très vite. Pour rester à la pointe sans se ruiner, de nombreux professionnels de santé optent pour le leasing. Ils peuvent ainsi renouveler régulièrement leur matériel pour suivre les progrès technologiques, tout en étalant la dépense. Les loyers intègrent souvent un contrat de maintenance, pour une tranquillité totale.

Machines agricoles

Tracteurs, moissonneuses-batteuses, ensileuses… Les exploitants agricoles ont besoin de matériel fiable et performant, mais qui coûte très cher à l’achat. Le leasing leur permet de disposer des dernières technologies sans se déposséder, avec la possibilité de renouveler leur parc régulièrement. En cas d’évolution de leur activité ou de leur SAU, ils peuvent aussi adapter leur contrat pour coller à leurs nouveaux besoins.

Comment Finalease Group Security peut vous aider ?

Vous êtes séduit par les avantages du leasing, mais vous ne savez pas par où commencer ? Chez Finalease Group Security, nous sommes là pour vous accompagner.

Forts de nos 30 années d’expérience dans la sécurité des biens et des personnes, nous vous proposons des solutions sur mesure adaptées à votre métier et à vos besoins. Notre offre comprend notamment :

- Un audit gratuit pour évaluer vos besoins en équipements de sécurité

- Des contrats de location flexibles, en moyenne d’une durée de 5 ans

- Du matériel haut de gamme : caméras IP, contrôle d’accès, portiques antivol…

- Un service de maintenance et d’assistance inclus

- La possibilité d’installer et de gérer votre parc à distance via une application mobile

Avec Finalease Group Security, vous pouvez sécuriser vos locaux et vos commerces en toute sérénité, sans immobiliser votre trésorerie. Nos experts sont à votre disposition pour étudier votre projet et vous proposer la solution la plus adaptée.

Alors, prêt à sauter le pas du leasing ? Contactez-nous vite pour profiter de nos offres du moment !